Health Savings Accounts (HSA) have become one of the more popular benefits that companies can offer their employees. While older people may not have been able to take advantage of this benefit in the past, since 2003, they have become a part of the medical landscape, often tied to a company health plan (although individuals can set them up for themselves).

One of the big benefits behind why HSAs were created in the first place is that the money deposited in them is tax-free income at the time of deposit. That income isn’t taxed until withdrawn. Whether or not that is actually an advantage for people depends a lot on what their medical needs are. For people who are healthy and don’t use the account, this can be another way of saving for retirement, when most people’s medical expenses go up.

But for those of us who are preppers, a HSA can be an additional source of income for buying prepping supplies. While you can’t buy just anything with a HSA, there are a lot of useful things you can buy with it. If your employer contributes to your HSA, that makes it like your employer is helping you to prep.

Before You Spend

Before going nuts with that money in your HSA, it’s a good idea to do what you have to do to make sure that your health is up to par. It doesn’t matter how many supplies you have, even how many medical supplies, if you aren’t in good enough health to make it; and in saying that, I’m including having the physical strength and stamina to do the various tasks associated with survival.

Related: 6 Things To Do Immediately After A Medical Collapse

Another part of this is taking care of any dental problems, especially serious ones. There are a lot of people who wait until a cavity is infected, before they will go to the dentist to get it taken care of. The thing is, you might not be able to go to the dentist to get it taken care of in a post-disaster world. That means depending on your buddy to pull that tooth out with a pair of pliers and no pain killer. Ouch!

Being healthy when going into a survival situation is worth more than anything that you can buy with the money in that HSA; and unless there is something seriously wrong with you, you’ll probably still have plenty of money left over that you can use to buy health and medical related prepping supplies.

So, just what prepping supplies can you buy with the money in your HSA?

First-Aid Supplies

The most obvious place to start using that money is in buying or building a good first-aid kit.

By “good” I’m actually referring to two different things. The first is that it be a trauma kit, able to be used to treat major injuries.

A little $19.95 first-aid kit isn’t going to be able to deal with the types of injures that any of us are likely to receive in a survival situation.

The other thing is that the kit be in-depth, meaning that there are more than one of the various supplies. Having a bandage large enough to handle a gunshot wound is great; but you really need several of them.

Medical Monitoring and Protection

Some types of medical monitoring equipment, such as blood pressure monitors, thermometers and a pulse oximeter are eligible for purchase with a HSA. All the personal protection equipment (PPE), such as masks and gloves, that we’ve been buying for COVID are reimbursable under the rules of a HSA.

Some types of medical monitoring equipment, such as blood pressure monitors, thermometers and a pulse oximeter are eligible for purchase with a HSA. All the personal protection equipment (PPE), such as masks and gloves, that we’ve been buying for COVID are reimbursable under the rules of a HSA.

Considering the possibility of another pandemic, stocking up now, while those items are available, makes a lot of sense.

Durable Medical Equipment

Some of us are getting older or may have aging parents. That adds additional survival challenges. Some of those same challenges, like mobility, can exist due to injuries incurred while trying to survive, rather than age.

Some of us are getting older or may have aging parents. That adds additional survival challenges. Some of those same challenges, like mobility, can exist due to injuries incurred while trying to survive, rather than age.

Related: 17 Lessons Learned From An 80 Year-Old Nurse

Crutches, canes, wheelchairs and a variety of other equipment can be bought with a HSA, allowing you to have those items on-hand, just in case.

Spare Pair of Eyeglasses

Those of us who wear prescription eyeglasses can find ourselves all but incapacitated without them. Yet those glasses are fragile items, which can easily become damaged or even destroyed. A spare pair of glasses is a small investment to make, in order to ensure that you’ll still be able to see after a disaster.

Those of us who wear prescription eyeglasses can find ourselves all but incapacitated without them. Yet those glasses are fragile items, which can easily become damaged or even destroyed. A spare pair of glasses is a small investment to make, in order to ensure that you’ll still be able to see after a disaster.

Better yet, that small investment can come out of the funds in your HSA.

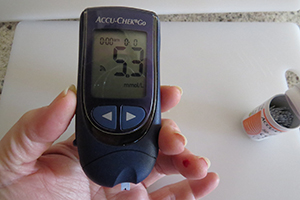

Diabetes Test Supplies

For those with diabetes, you can buy diabetic testing supplies (needles and strips) with the money in your HSA. You may not have to touch this money though, as many health plans also include free diabetic supplies.

For those with diabetes, you can buy diabetic testing supplies (needles and strips) with the money in your HSA. You may not have to touch this money though, as many health plans also include free diabetic supplies.

Related: Preparedness for People with Diabetes (How to Make Insulin)

Either way, diabetics should have the means to monitor their blood sugar, even in the event of a disaster, so it’s a good idea to have extra supplies.

One actual advantage that a survival situation offers the type 2 diabetic is that when they do encounter that their blood sugar is high, they can just do some physical work to bring it down, burning off that excess sugar. Over the long term, most of us will lose weight during that post-disaster time, which could very well allow most diabetic’s bodies to heal, eliminating the diabetes.

Food for Guide Dog

This one doesn’t apply to many people; but if you’ve got a family member who has a service animal, such as a guide dog, you can actually buy food for that dog with the HSA. An extra hundred pounds of dog food, or more, is a good addition to your prepping stockpile, allowing you to save your canned meat for your family, rather than the dog.

This one doesn’t apply to many people; but if you’ve got a family member who has a service animal, such as a guide dog, you can actually buy food for that dog with the HSA. An extra hundred pounds of dog food, or more, is a good addition to your prepping stockpile, allowing you to save your canned meat for your family, rather than the dog.

In a pinch, your family can even eat the dog food.

Hearing Aids & Batteries

This one goes back to the idea of taking care of your health needs now, using the money in the HSA, rather than waiting until it’s too late.

This one goes back to the idea of taking care of your health needs now, using the money in the HSA, rather than waiting until it’s too late.

Hearing aids are expensive, so getting a hearing aid now, if it looks like you might need one, is a good idea, even if you don’t actually use it now.

Better to have it and be prepared, if it looks like your hearing is going that way, than to need it and not have it. Batteries for those hearing aids may not be a big expense, but it’s nice to be able to stock up on them, without having to take the money out of your pocket.

Prescription Medications

Probably one of the first groups of people to die off in the wake of a TEOTWAWKI event will be those who need prescription medications to deal with chronic conditions. Whether that is nothing more than high blood pressure or is something that keeps people from functioning normally, those medicines are essential for the individual’s lives. But once the brown stuff hits the air movement device, they won’t be able to get them anymore.

Taking advantage of your HSA to help alleviate this situation is either going to require an understanding doctor or a trip to Mexico. The understanding doctor can write prescriptions, allowing you to buy enough of the medicine to last a year or more. While that isn’t a permanent solution, it will help.

If your family doctor isn’t understanding, you can probably buy the same medications in Mexico, even without a prescription. The challenge there is getting reimbursed from the HSA, but that’s just a hassle, it’s not impossible.

Antibiotics

As with other prescription medicines, an understanding doctor can help you with stockpiling antibiotics. While not everything can be treated with antibiotics, many things, including many common things, can.

As with other prescription medicines, an understanding doctor can help you with stockpiling antibiotics. While not everything can be treated with antibiotics, many things, including many common things, can.

Related: Where to Buy Survival Antibiotics without Prescription?

Keeping a few general-purpose, broad-spectrum antibiotics on-hand should be an essential part of your prepping stockpile.

Antibiotics can be purchased in Mexico at any pharmacy, without a prescription. You can even get them in bottles of 100 pills. Be sure to take spend some time online, downloading information on what each should be used for and dosage charts.

Feminine Hygiene Products

Along with the aforementioned over-the-counter medications, the CARES act allows for the purchase of feminine hygiene products with FSA funds. That may not make much of a difference to any men reading this article, but I guarantee you, it will to your wife and daughters.

Along with the aforementioned over-the-counter medications, the CARES act allows for the purchase of feminine hygiene products with FSA funds. That may not make much of a difference to any men reading this article, but I guarantee you, it will to your wife and daughters.

Over-the-Counter Medications

Hidden away in the Coronavirus Aid (CARES) Act was a provision, allowing most over-the-counter medications to be purchased with HSA funds. This includes such common items as pain relievers, nasal sprays, laxatives, allergy and sinus medicine, acid reducers and eye drops.

Make Home Improvements

If anyone in the family has a chronic health issue that requires modifications to the home, such as adding in a ramp for someone who is wheelchair bound, the law allows for expenditures from a HSA to make these modifications. Some restrictions do apply to this and it may be necessary to get a note from your doctor, so check on it before making any construction plans.

You may also like:

How To Make Oil From Plants At Home

How To Make Oil From Plants At Home

The Only 4 Antibiotics You’ll Need When SHTF (Video)

a shame they backed down handing out pain killers like candy…. That would of been a much option to spend the money on.

Studies have shown that a dose of 4 Excedrin Migraine pills buffered with a 20mg pill of Famotidine (OTC antacid) is a better pain reliever than Opioids. Have to pay attention to the side effects, but they are less severe than the potential of addiction you have with Opioids. Big difference, Excedrin doesn’t give you that dreamy everything is GREAT high that Oxy does. Generic at China-Mart is 4$ for 200 pills.

Bad things happen when you least expect them. From my experience as a caregiver I would add to the list of necessities, a couple of bed pans, a big stock of adult diapers, lots of baby wipes (Pampers Sensitive the best!) as well as a couple pairs of crutches. You really can’t hobble around on a tree branch when you have a painful leg injury.

yeah somehow as someone who used oxy for his pain relief …. i’ll beg to differ…. I think some people need that cloud feeling and letting them sleep.

Good to know, Judge, thank you. niio

Yes, that is a shame. It is almost on the edge of malpractice. My Granddaughter had a broken arm a year ago and they only gave her Tylenol.

Try getting Dental surgery with bone trimming and see what they WON’T give you for the excruciating pain.

Agree, the Docs get into trouble for over prescribing dope, then they won’t give it when needed.

I love the stone from opioids and it can be therapeutic, but Excedrin Migraine is also great for pain relief and it is a lot more practical to stock up on an OTC generic than on a narcotic. Plus you don’t have to worry about your 13 year old kid stealing your stash. Nothing corrupts a human like Opioids and Meth will.

Broke my back in two places – T-6 and T-12 compression fractures and they would only prescribe aspirin for the pain. I was fortunate that I had saved my husbands hydrocodone from his illness. I had vacuum packed then so they were still good – not degraded

In my decades of experience with HSA benefits – the hurdle is your benefits manager and not the IRS >>> if you have something major $$$$ in mind – submit the purchase first and get some written confirmation that you have the prior OK …

So, riddle me this, when creating an HSA the money you put in it is tax free until you withdraw it? Was it not just taxed before I was able to put it in there in the first place? Why would they tax it again at withdraw? Seems odd, would you not agree? How many times do they want to tax the same dollar?

I had the same questions. Everyone’s answer was that the money comes out before taxes. I want to believe, I want to believe, I want to believe, . . .

it’s pulled out of the check prior to ANY deductions including any 401K – when you designate the %%% you want deducted do the math and determine the yearly lump sum – you’ll need to spend the whole amount or it’s a $$ loss – don’t cut into your required living expenses or exceed practical medical needs …

I think he misspoke. I am not taxed on my HSA when I withdraw unless I use it for an ineligible purchase.

HSA accounts don’t expire at the end of the year. That’s a Flex Spending account. HSA accounts usually roll over from one year to the next.

About eating dog food. As I understand it, some dog food contains bone – which is why cats shouldn’t eat it. It’s EXTREMELY rough on the digestive system – for people, too.

if you EVER saw a dog food plant that uses the slaughterhouse offal >>> you wouldn’t even go down the dog food aisle in the grocery …..

Excellent article.

I have used my HSA for about 3 years now. It is taken out before taxes. Not taxed on accepted purchases such as medical or medicine. It rolls over and can be used however you see fit after retirement.

My regular insurance went up to more than i was willing to spend per month so i did the HSA out of self defense. It saved me money, and i have had to deplete it twice on surgeries. It works for me..

The evil company I used to work for offered an HSA, BUT if you didn’t use the money, you lost it. Hard to believe, I know, you’d think that was illegal, but it wasn’t at the time (about 7 years ago now).

The thing I just don’t get about HSA programs is why people just don’t take the $10 a week (or whatever amount) and either put it in the bank or keep it at home, where you can get to it and use it for whatever emergency comes up. Yes, it requires a certain amount of discipline, but are people really so weak they will blow the money on something stupid unless someone else only doles it out for specific things?

Oh, wait…that would be a yes, wouldn’t it?

As far as opiates go, I know a lot of people are getting good results from marijuana for chronic (pun intended) pain. If you live where it’s legal, it might be a good alternative.

I used to use extra strength Excedrin migraine, and it worked great, but I developed an allergy to the aspirin in it. Aspirin can also aggravate ulcers and exacerbate bleeding, so be aware of that, especially if you take a blood thinner.

My doctor said take two aspirin every 4 hours – worst case of hives – ever! A little is good – a lot, not so much.

Don’t know, don’t have one. So far, the VA cares for it, and we make our own meds. niio

My employer only allows an employee to participate in the HSA plan if said employee is enrolled in the disaster health insurance plan. The disaster plan has less expensive biweekly payments, but the disaster plan does not cover ANYTHING until the bill hits $6,000. My continuous glucose monitor, and insulin pump supplies cost almost $2,000 per month. Add in the insulin at over $300 per vile (most of us type 1s use one per week) and… well you get the idea.

As far as opiates go. I had to have major surgery in 2020. I spent most of that year on such pills. I did not get any dreamy feeling. I got pain relief. Last month I spent time in the hospital ($1,100 ambulance ride for 2.7 miles). The hospital was so understaffed that they just kept putting opiates in my IV. I never got a great feeling. The pain would go away and I slept. I was the easiest patient there. I just slept for a week.

We do what Miss Kitty suggested. Every pay period, we put cash in the bank for medical emergencies. If we do not use it, we continue to add money. If there is an unexpected need for cash (water heater died in December), we don’t add to the medical savings that month.

This technology is a lifesaver literally. While my job at https://logoglory.com/ , I’ve suffered a lot due to a bad internet connection but after knowing about this, my life becomes much easier than before.

Buying from Mexico pharmacies is like Russian roulette. You really don’t know what you’re getting. Many Americans are dead because of fentanyl being mixed in with regular medications. Other than Mexico, is there an alternative place to get prescription meds?